A plot-point in numerous books, films, and TV shows, the tontine is among the most notorious financial products every devised. But, as Dr Andrew McDiarmid explains, this most infamous of investment schemes had a notable – and broadly positive – impact on Scotland during the early 19th century. Follow Andrew on Twitter at @apmcdiarmid1.

From the 1690s until well into the nineteenth century, the tontine touched on almost every aspect of British society and culture. It began as a tool of the state, with successive English, and then British, administrations offering seven tontine schemes between 1693 and 1789, with all but one subsidising the financial cost of one war or another. Then, as it became less popular with governments, it was picked up by private groups, who used it to raise capital for a myriad of local cultural and infrastructural projects up until the 1850s. This meant that being a patron of a hotel or coffee-room funded by tontine subscription, by worshiping in a tontine church, or even walking over certain London bridges brought you into contact with the fruits of a tontine. In Scotland the tontine was an important funding source for diverse projects. From hotels in Peebles and Helensburgh, taverns and inns in Edinburgh and Cupar, public baths in Ardrossan, and coffee-rooms, assembly halls, and full streets of property in Glasgow, the tontine was successfully employed to raise project capital. Now, some of you may be thinking, ‘well, this is all great, but what exactly is a tontine?’; good question.

The Tontine Explained

You may have a rough idea about the tontine. It has been used as the plot device in several novels, plays, films, and tv shows (even an episode of The Simpsons!). These have generally focused on the nefarious dealings of fictitious tontine subscribers and have done little for the reputation of this financial instrument. In the real world, the tontine is a shared investment fund which offers subscribers an annuity payment secured on a nominated life. Annuity payments are offered at a defined interest rate, and taken from a central pot that is divided among the subscribers. So far this sounds rather like a run of the mill life annuity scheme. What separates that from the tontine, however, is that as nominees die, and as their associated subscribers retire from the scheme, the annuity payment linked to them does not revert to the tontine organisers, but is distributed among active subscribers, permanently increasing their yearly dividend. This structure means that it is possible for the last subscriber to collect an annuity that had previously been divided among every other subscriber in the tontine. It is this winner takes all model that has inspired many writers to pen stories of murder and intrigue around the tontine.

The potential windfall from a tontine could be substantial. Let me give you a clearer example of how a scheme operated. Imagine for instance that a tontine scheme offered 100 shares priced at £100 each. This would raise a total of £10,000, which would go to the organisers for whatever purpose they had initiated the tontine. In exchange for a £100 share price, subscribers would be offered an initial interest rate, which for the sake of this example is 5 per cent. This would mean that £10,000 generated a pot of £500 to pay subscribers’ annuity payments. Subscribers were required to name a nominee against whose life the yearly dividend will be contingent – this was usually a family member, often a young child, or it could be a ‘public live’ such as a young royal – and each subscriber would be paid £5.00 per annum as long as their nominee was alive.

A £10,000 pot therefore generates £500 in interest, and this is divided between 100 subscribers at £5.00 each. However, as nominees die and subscribers leave the scheme, those still taking part would see an increase in their yearly payment. For instance, if after 10 years, 25 nominees had died, then the £500 dividend would be split 75 ways, rather than 100, giving the remaining active subscribers a dividend of around £6.66. This would continue until all nominees had died and the tontine was wound up. In the interim, however, it presented the opportunity for a significant return. For example, with 50 investors remaining, the annuity payment would be £10, at 25 it would be £20, and only one subscriber remained, each year they would receive the full £500 that had previously been divided between 100 subscribers, until their nominee was dead!

The Rise and Fall of the Tontine

The man usually attributed with the idea for the tontine is Neapolitan banker, Lorenzo de Tonti, from whom the scheme took its name. There are some earlier examples of tontine-type schemes, but it was Tonti’s proposal, promoted in France in the early 1650s, which developed the framework upon which future tontines were largely based. Tonti’s tontine failed, however, to get past the planning stages, and it was not until five years after his death in 1684 that the French dusted off the proposal and initiated a state-operated tontine. In 1693 the English followed suit, and over the next century or so, both countries operated 17 tontines of varying success. However, due to the complexity of administering such a system (the task of verifying that a nominee was alive in a world of pen and ink was not easy), and with the emergence of cheaper forms of government borrowing, the tontine waned in popularity with the state.

As governments were winding down their interest in tontines, the scheme was beginning a second life as a tool of private groups. As this financial instrument shifted from the state to these groups, it did so primarily in two forms. One raised capital in order to buy government bonds (consols), and paid dividends from the collected interest. The second type of tontine was used to raise capital for building projects, paying a secure rate of return from rents or tolls. This form of tontine also offered an additional form of return on subscribers’ investment, over and above the annuity payment. On many private tontines it was not unusual for the final subscriber to take ownership of the project built with tontine capital. So, one might find that their initial payment had provided them with a generous return over the years, and then also a tavern, hotel, home, or whatever the capital had been used for. It should be noted, however, that the term of a tontine could be long – depending on when the last two nominees become one – so it was not always the initial subscriber that benefited the most. Often their subscription was sold, or inherited by a family member, or sometimes even left to the nominee themselves.

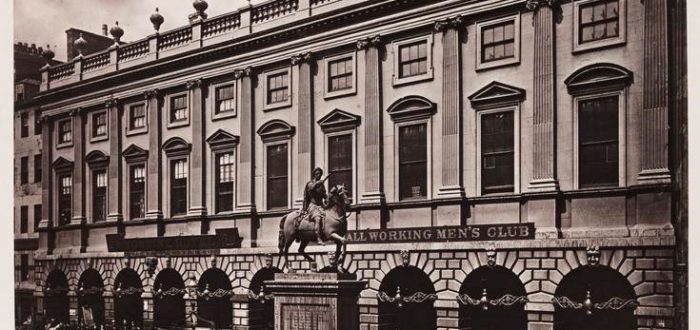

Examples of using tontines to fund local projects can be found as early as the 1750s in England, and became increasingly popular in Scotland from the 1780s onwards. Tontine hotels popped up across Scotland, from Glasgow to Edinburgh, and Greenock to Peebles. These became important community venues for political meetings and public functions. Coffeerooms, where merchants could meet to conduct business and read the national press, were erected with tontine funding. Inns and taverns, libraries, local baths, were built across Scotland with the money raised via local, private tontines. Today we can still see the impact of the tontine boom in Scotland. Some buildings in Glasgow, Peebles and elsewhere retain the name, whilst others have since dropped it. Even without the name as a reminder there are buildings, and even whole streets in Scotland, which were financed through the scheme.

The tontine was a significant funding tool, but it was not without its issues. State-operated schemes were especially difficult to administer, checking the status of nominees and paying payments on a huge level by the standards of the day. Local, private schemes with smaller investment and nominee pools were much easier to oversee. Perhaps the biggest problem for the tontine, however, has been one of reputation, with the aforementioned fictional works doing significant damage to this. Evidence would suggest, however, that rather than the tontine being the motive for murder, with subscribers seeking to remove rival nominees from the running, it was much more likely that the tontine inspired resurrections. This can be seen with subscribers who had named a child as their nominee, who would, upon the premature death of this child, give a new born child the same name, or use another child to pose as the dead child. The thought of this may seem unsavoury, but the fraud is more palatable than murder,

Conclusion

The tontine is undoubtedly an interesting financial instrument, and despite its infamy, it was an important funding source in Scotland, and elsewhere in Britain. I hope the research I am conducting may go some way to repairing the scheme’s reputation and demonstrate how important it was as a fund-raising tool across Britain.

Further reading

M. Milevsky, King William’s Tontine: Why the Retirement Annuity of the Future Should Resemble its Past, (Cambridge, 2015)

D. Green, ‘Tontines, annuities and civic improvements in Georgian Britain’, in Urban History, 46(4, 2019), pp. 649-694

K. McKeever, ‘A Short History of Tontines’, in Fordham Journal of Corporate & Financial Law, vol 15, no. 2, (2009), pp.491-521

Note: This research forms part of the project, ‘Crowdfunding Projects in Scotland during the long-eighteenth century: A study of Tontine equity financing’, and was undertaken during a postdoctoral fellowship with the Institute for Advanced Studies in the Humanities (IASH) at the University of Edinburgh.

Comments are closed.